Join those who are already making the difference

THE BANKER - Being the bank for Hong Kong’s first corporate digital bond

HSBC’s Orion platform was instrumental in the groundbreaking financial transaction.

By Shanny Basar

December 23, 2024

Deal Analysis: Hong Kong’s HK$6bn digital green bond offering

After the world’s first multi-currency digital bond offering was oversubscribed, a government spokesperson told FA that tokenized bonds are moving from ‘proof of concept’ into ‘production’.

By Ryan Li

March 05, 2024

HSBC Delivers World's First Multi-Currency Digital Bond Offering

Using HSBC Orion, the bank’s leading digital assets platform, HSBC has successfully helped the Hong Kong Monetary Authority (HKMA) complete a HKD6 billion-equivalent digitally native green bond issuance for the Hong Kong government.

15 February 2024

Societe Generale issues a first digital green bond on a public blockchain

On 30 November 2023, Société Générale issued its first digital green bond as a security token on the Ethereum public blockchain through its subsidiary SG-FORGE. This issuance aimed to enhance transparency and traceability of ESG data.

04 December 2023

On 30 November 2023, Société Générale issued its first digital green bond as a security token on the Ethereum public blockchain through its subsidiary SG-FORGE. This issuance aimed to enhance transparency and traceability of ESG data.

04 December 2023

From ripples to waves: The transformational power of tokenizing assets

Tokenized financial assets are moving from pilot to at-scale deployment. Adoption is not yet widespread, but financial institutions with blockchain capabilities in place will have a strategic advantage.

By Anutosh Banerjee, Julian Sevillano, and Matt Higginson

June 20, 2024

THE BANKER - BNP Paribas embraces tokenisation for project finance bonds

A cross-bank effort demonstrated bond tokenisation’s potential in project finance and other types of bond issuance, even for smaller issuers. Edward Russell-Walling reports.

By Edward Russel-Walling

November 14, 2022

ABN AMRO registers first digital green bond on the public blockchain

ABN AMRO is the first Dutch bank to register a digital green bond on the public blockchain. With this innovative bond, Vesteda raised EUR 5 million from DekaBank. The proceeds of the transaction will be used to (re-)finance Green Assets, in line with Vesteda's Green Finance Framework.

By Jarco de Swart

September 12, 2023

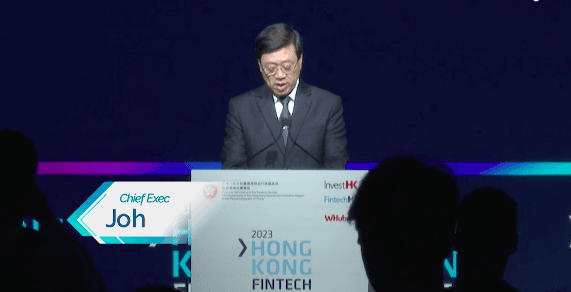

Hong Kong Green FinTech Hub

CE John Lee - Hong Kong Exchanges & Clearing will set up a new integrated fund platform. It will focus on services related to fund subscription and redemption, settlement, the information portal and more. It will strengthen connectivity between Hong Kong’s fund industry and the Mainland’s financial markets in the long run, and boost Hong Kong’s competitiveness as an international hub for funds.

November 2, 2023

Mobilising Green Investment - 2023 Green Finance Strategy

HM Government, March 2023

Securities are offered through Finalis Securities LLC Member FINRA / SIPC. Climate Kick LTD is not a registered broker-dealer, and Finalis Securities LLC and Climate Kick LTD are separate, unaffiliated entities. Finalis Securities LLC, Office of Supervisory Jurisdiction is located at 450 Lexington Ave, New York, NY 10017, 800-962-0418.

Finalis Privacy Policy | Finalis Business Continuity Plan | FINRA BrokerCheck | Finalis Form Customer Relationship Summary (“Form CRS”)

https://www.climate-kick.com/ (the "Climate Kick LTD Website") is a website operated by Climate Kick LTD. This website is for informational purposes only, is not an offer, solicitation, recommendation, or commitment for any transaction or to buy or sell any security or other financial product, and is not intended as investment advice or as a confirmation of any transaction. Products and services on this website may not be available for residents of certain jurisdictions. Please consult with a Finalis Securities’ registered representative regarding the product or service in question for further information. Investments involve risk and are not guaranteed to appreciate. Any market price, indicative value, estimate, view, opinion, data, or other information herein is not warranted as to completeness or accuracy, is subject to change without notice, and Climate Kick LTD along with Finalis Securities LLC accepts no liability for its use or to update it or keep it current.

Investing in private placements involves a high degree of risk. These investments may be illiquid, speculative, and subject to substantial restrictions on transferability. Investors may lose all or part of their investment and should only invest capital they can afford to lose. Prospective investors should conduct their own due diligence and consult with their legal, tax, and financial advisors prior to making any investment decision. For your reference, Finalis’ Form CRS describes the services that we provide, how we are compensated, and other important information about Finalis Securities LLC.